The Evolution Of Reward Cards

I have been catching up with some old friends lately, and I have been trying to explain reward cards and loyalty programs came to be.

In The Beginning…

Have you ever been to a dry cleaners or a sandwich shop that hands out a loyalty card. The idea is that when you make so many purchases, you get a reward, typically a free product or service. From the consumer’s standpoint, it is something for nothing, while from merchant’s standpoint, it has been shown that consumers will return to earn their award rather than try a competitor. In 1981, American Airlines was the first major airline to apply the same principal to air travel. In this case, the passenger ear miles towards a free ticket. One mile was earned for each mile flown. To this day, it is a mystery to me why they chose Statute Miles over the world standard Kilometers, or the aviation standard, the Nautical Mile. Indeed, South American Carrier LAN actually does use Kilometers. What might have made the most sense was earning points based on dollars spent, but since when have the major airlines ever been accused of trying to make sense?

Later, airlines started offering ways to earn miles without leaving the ground. Credit cards were an obvious way to this. Merchants have been in the credit card business for a long time. My parents like to tell the story of their first credit card from Sears, sometime in the late 60s or early 70s, that had a credit limit of $50 or so. Later, my parents used their credit history to obtain a card at the gas station, before finally getting a standard credit card. How quaint. Not long after frequent flier programs began, airline branded credit cards were offered that earned miles, typically one mile per dollar spent. As the dollar lost value to inflation, miles earned through credit cards became much easier to earn. The value of the dollar decreased substantially since the 70s while the world stayed the same size. All I need to do now is find a credit card that offers a frequent flier point per Zimbabwe Dollar that I spend, and I should be earning around the world flights on my lunch break!

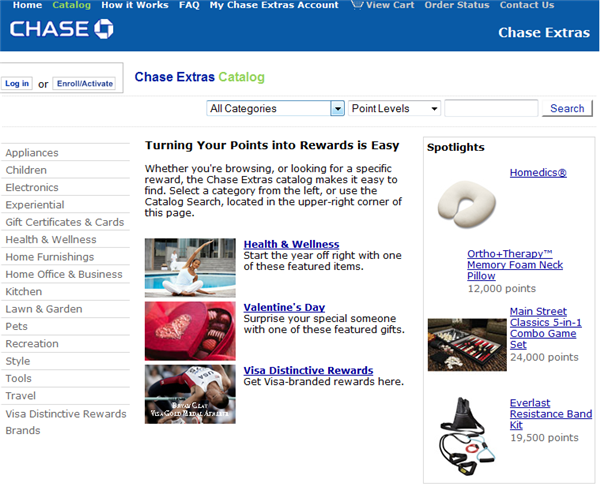

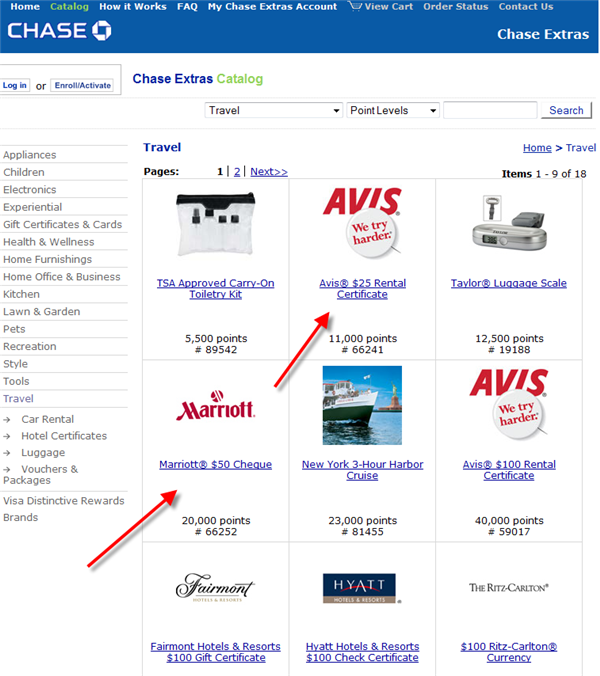

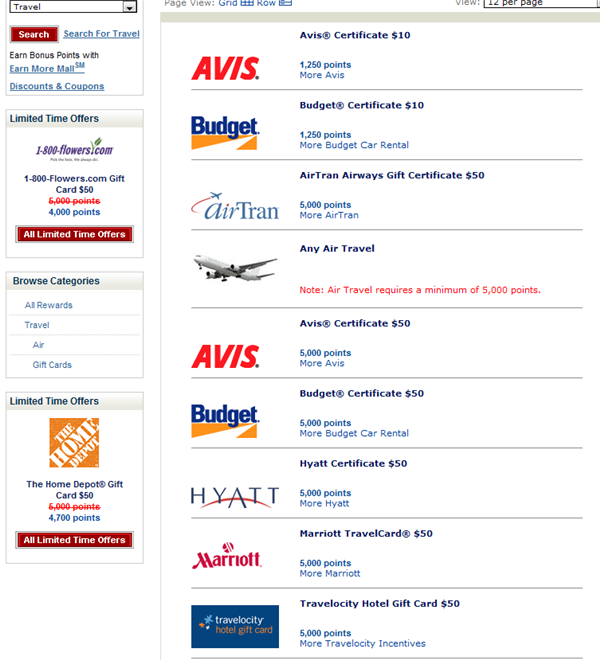

At the same time, airlines began offering miles through travel partners such as hotels and rental car companies. Eventually, you had the opportunity to earn miles on just about any purchase from the Home Depot to hair loss treatments.

Today

It is far easier to earn miles with a credit card or an airline partner than it is to step on a plane. For example, you could take a last minute flight from Washington Dulles to Roanoke Virgina for $470. You will only earn 177 miles from the flight itself, but you could earn at least 470 miles or points with your credit card while you pay for the flight. That is an extreme example. A more common example would be a flight from Denver to Atlanta. It is 2,400 miles round trip, and an advanced purchase fare is often around $300. So you are earning 8 miles per dollar spent. Many shopping partners offer similar or more mileage per dollar spent. Credit cards typically offer a single point or mile per dollar spent on anything.

For very frequent fliers, they will probably earn more mileage in the air than on the ground. I am talking about people who travel at least two or three times a month. Even then, they can earn tremendous mileage with partners, enough to outstrip their actual BIS (Butt In Seat) miles. For the rest of us, we can now earn thousands of “frequent flier” miles without ever leaving the ground.

More Than Just Miles

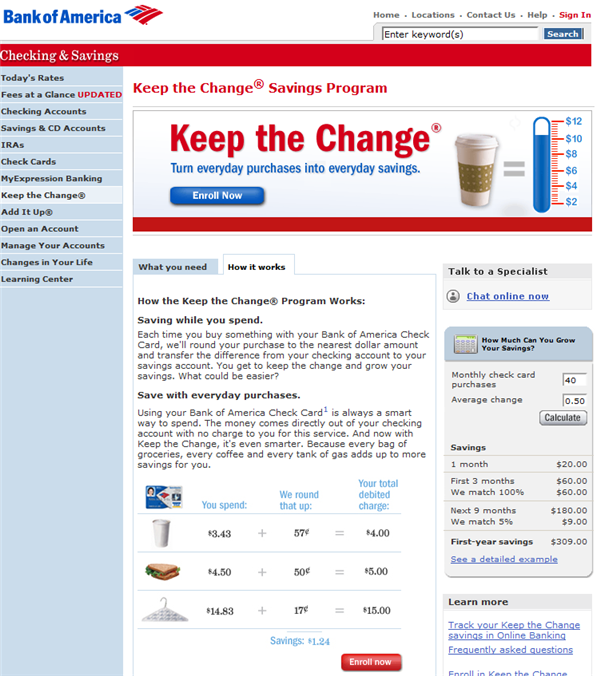

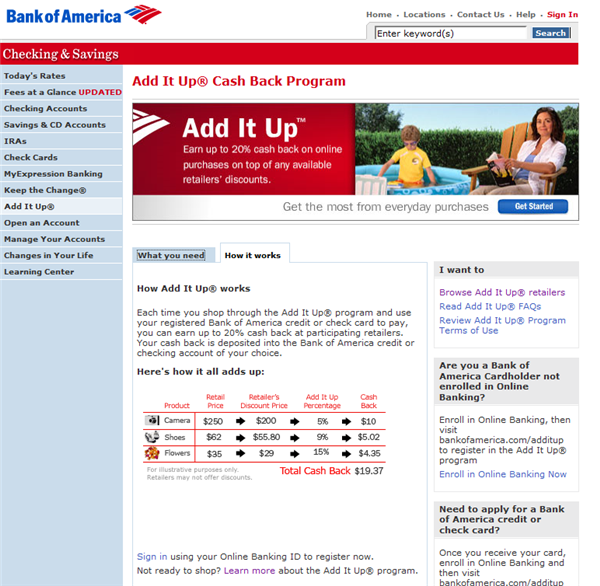

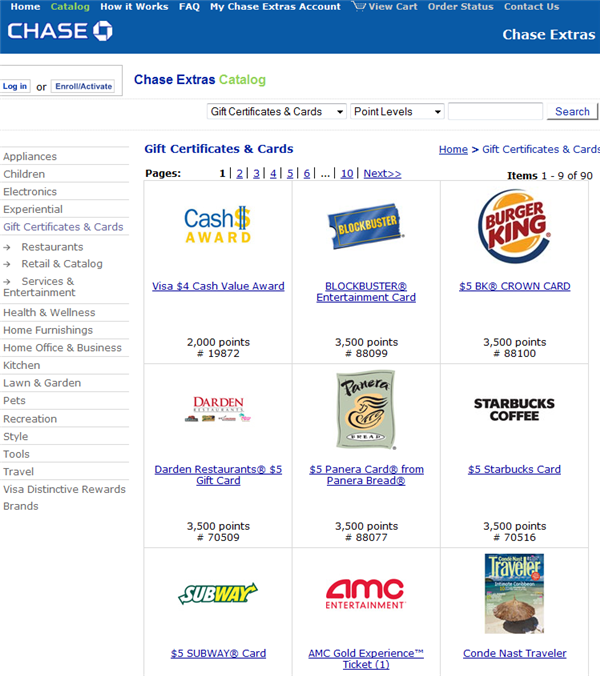

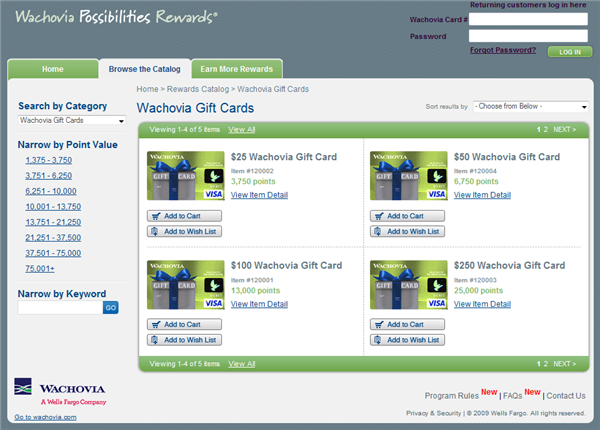

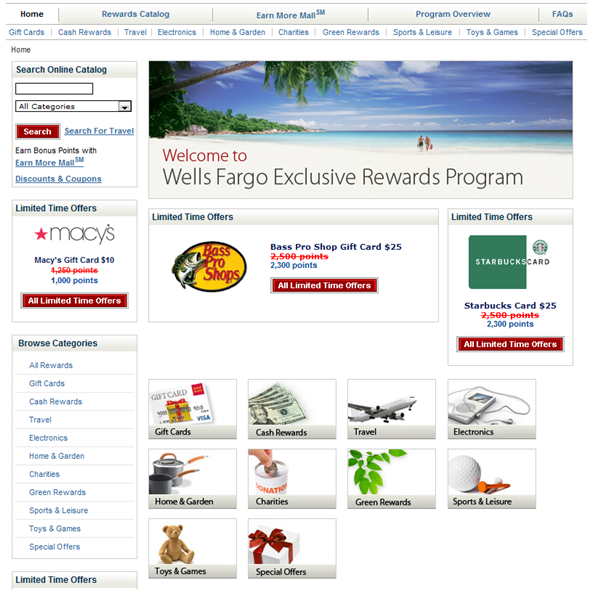

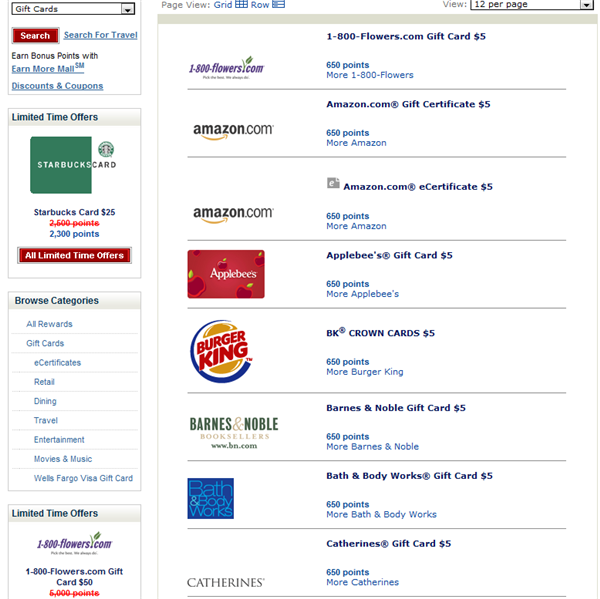

Of course, along with miles came other loyalty programs and point schemes. Hotels and rental car companies got into the act with similar programs. Credit card companies started offering their own point schemes as well as the most attractive option, cash back. Every time you use your credit card, the merchant has to pay 2-4% of the purchase price to the credit card processor. Your bank is using a percentage of those funds as a bribe to entice you to use their card. Currently, the best cash back cards give you 2%, a pretty substantial rate of return.

Simply put, if you are not utilizing reward cards, you are leaving a lot of money on the table. With a basic 2% cash back card, someone who spends $30,000a year ($2,500 a month) is earning $600 in rewards. Since the rewards are merely a discount on your purchases, they are not taxable. Think of it like a $1,000 a year pre-tax raise on your salary. Savvy reward card users can find rewards out there worth 4 cents on top of every credit card dollar spent, or even more.

The Most Important Part

The whole idea of earning reward points and miles with a credit card is predicated on the idea that you will ALWAYS be paying your credit card balance IN FULL and ON TIME. Failing to do so means that you have lost the reward card game, as the interest and late fees will always exceed any reward.

My Advice

Read this blog and others. Learn the ways of reward cards and you can profit greatly from your everyday spending habits.