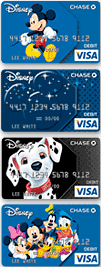

Disney Rewards Debit Card Review

The Disney Rewards Debit Card is a debit card for those with a Chase checking account looking to earn some Disney reward points. Let’s look at this debit card in closer detail.

The Disney Rewards Debit Card is a debit card for those with a Chase checking account looking to earn some Disney reward points. Let’s look at this debit card in closer detail.

Earning Disney Dream Reward Dollars – I guess the main purpose of getting this debit card (among the ones that Chase offers) is to actually earn Disney Dream Reward Dollars (as they call their reward points). You will earn one Disney Dream Reward Dollars for every $200 that you spend on the card for non-pin transactions. You will earn 25 bonus reward points after 5 qualifying non-pin transactions.

Other card member benefits – A Disney Debit cardholder also has the following benefits (which I have taken directly off the Chase site):

Fees – The Disney Dream Rewards Debit Card comes with a $25 annual fee.

Is this a good debit card? – Well, in terms of ability to earn rewards, the best thing to do is to compare with the Disney credit card. The regular Disney credit card allows you to earn one Disney Dream Reward point for every $100 dollar that you spend on the card and it also has no annual fee. So from a reward point earning standpoint, the Disney credit card is the better way to go. But, having said that, there are folks who just do not want to use a credit card and prefer a debit or check card instead. So if you have a Chase checking account and are willing to pay the $25 annual fee, the Disney Rewards Debit Card is another way of earning more Disney Dream Reward points from your everyday spending. Folks who go on Disney vacation every year might want to consider this debit card.

As with all debit cards from Chase, you need a Chase checking account. So make sure you check through all their offerings and choose the most appropriate one for yourself.

The Continental Airlines Debit Card is available to with Chase checking accounts. It allows you to earn Continental OnePass Miles each time you use the debit card. Let’s find out more about the card.

The Continental Airlines Debit Card is available to with Chase checking accounts. It allows you to earn Continental OnePass Miles each time you use the debit card. Let’s find out more about the card.

The United Mileage Plus Debit Card is a debit card that allows those with a Chase checking account to earn miles from a debit card. Let’s have a look at this debit card.

The United Mileage Plus Debit Card is a debit card that allows those with a Chase checking account to earn miles from a debit card. Let’s have a look at this debit card.

The American Express Zync Card is a new charge card that is being introduced by Amex. It is targeted at a younger audience who did not grow up in awe of their traditional Green and Gold charge cards. The Zync is a charge card but with a slight twist. Let’s explore this card in greater detail.

The American Express Zync Card is a new charge card that is being introduced by Amex. It is targeted at a younger audience who did not grow up in awe of their traditional Green and Gold charge cards. The Zync is a charge card but with a slight twist. Let’s explore this card in greater detail.