Many people are traveling around the country during the holidays to see their family. For many Americans, visiting family entails traveling to other countries. In the rush to finalize travel arrangements and pack your luggage, it is easy to forget about some important travel considerations regarding your bank and your credit cards.

When You Plan Your Trip

Hopefully, you are planning your trip some months in advance. It is at that time that you need to think about your method of payment when traveling overseas. For me, all of the reasons that I do not like to have cash when I am at home are even greater when I am traveling. Let’s face it, when you are in a foreign country, you stick out like sore thumb as an American tourist. This can make you a great target for theft and fraud. When possible, I like to travel with as little cash as necessary. Nevertheless, I always carry my ATM card with me. Ironically, the banks many foreign countries are less likely to charge you service fees at ATMs than banks in the United States. It is always a good idea to check your bank’s policy on overseas transactions just to make sure. If they impose a lot of fees, you may consider opening another account at a bank without such fees, if only for the purposes of the trip. A benefit of this strategy is that you may protect your main bank account from the possibility being compromised in any way.

When it comes to credit cards, almost all cards charge a large foreign transaction fee, typically 2-4%. These fees are pure profit, and from my perspective, a pure scam. Do yourself a favor and take this opportunity to apply for a Capitol One, Schwab Bank card, or one of a handful of other credit cards that do not charge these fees. Only use that card when traveling in other countries as few rewards are worth a 3% negative cash back. While your fee free card will be your primary card, keep some others as backups, preferably in a separate location.

A Week Before Departure

Contact your banks to tell them which countries you will be visiting and the dates of your visit. Be sure to include any countries that you may step foot in, even if you are just changing planes. The last thing you want is to have your card canceled because you bought lunch at the airport, or had to check into a hotel following a flight cancellation. You also may want to include any countries that you may enter along a border region that you are visiting. I just wouldn’t want to worry about my card being canceled should I make a quick day trip across a border. Interestingly, American Express claims that they no longer need notification as their system is set up to account for foreign travel.

Banks have collect call lines for contacting them from outside the United States in an emergency. Write down all of these numbers somewhere safe, just in case.

Finally, make note of your statement closing dates and payment due dates. You don’t want to miss a payment because you never got your bill. If a payment is due while you are away, learn how to log into your bank’s web site and make a payment from the Internet.

Tomorrow, I will fill you in on some tips for when you are on your trip.

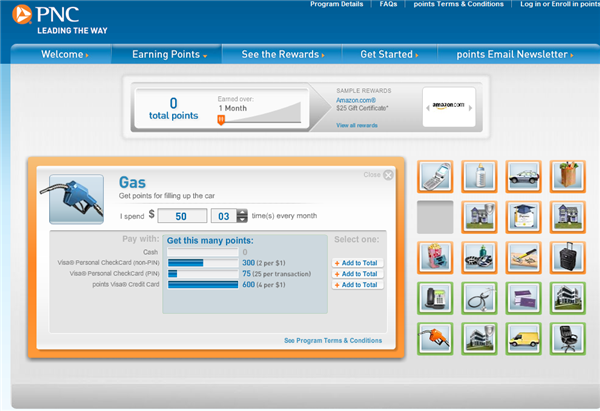

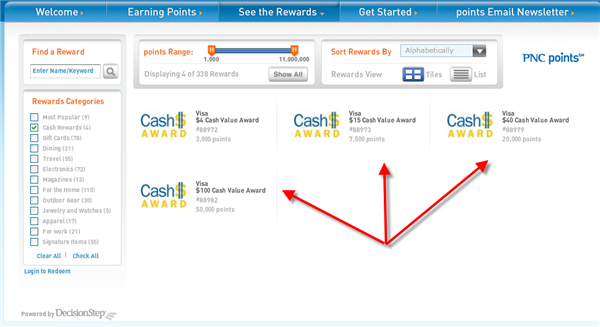

The PNC Bank Visa Check Card is a check card (or debit card) that is issued to folks who have a checking account with PNC bank. Let’s find out more about this card.

The PNC Bank Visa Check Card is a check card (or debit card) that is issued to folks who have a checking account with PNC bank. Let’s find out more about this card.