some questions about reward cards

some questions about reward cards

some questions about reward cards

some money saving tips

Old Navy has two types of credit card, a store card which can only be used at their outlets and a Visa credit card which offers various types of rewards. We’ll check this card out to see if it is any good.

Old Navy has two types of credit card, a store card which can only be used at their outlets and a Visa credit card which offers various types of rewards. We’ll check this card out to see if it is any good.

Rewards – The Old Navy credit card allows you to earn five points for every dollar that you spend at Old Navy, Banana Republic, GAP, Piperlime and Athleta outlets. You earn one point for every dollar that you spend on other regular purchases. Once you have accumulated 1,000 points, you will get a $10 reward card to use at any of the above outlets. New card holders get to save 10% when they use their card for the first time. You can also get an additional 1,500 points if you sign up for email alerts.

Other Perks – Aside from the reward points, the Old Navy credit card also has a few other perks.

Fees – There is no annual fee for this card.

Verdict – The Old Navy credit card appears to be a decent credit card if you really shop a lot at their stores, as well as the Banana Republic and GAP. If you are find yourself constantly shopping there, then perhaps this is a suitable card to get to earn discounts and rewards. But I suspect that most people not only shop at Old Navy, GAP or Banana Republic, but at many places as well. If you happen to fall in that camp, then I would suggest you consider getting the Discover® More(SM) Card as they have a shopping portal called shopdiscover.com that allows you to earn 5% rebates at oldnavy.com, gap.com, bananarepublic.com and piperlime.com. As long as you go to these sites by logging into your Discover account (and obviously use your Discover Card), your purchases will be tracked and you can earn these rebates. Below are screen shots of the process.

In the example below, I clicked on the Old Navy icon and it takes me to the page with all the details and fine prints. Once I click on the start shopping button, it will take me to the OldNavy.com store where any purchase you make with your Discover Card will be tracked and you will earn the 5% rebate. The same process goes for Banana Republic, GAP, Piperlime etc.

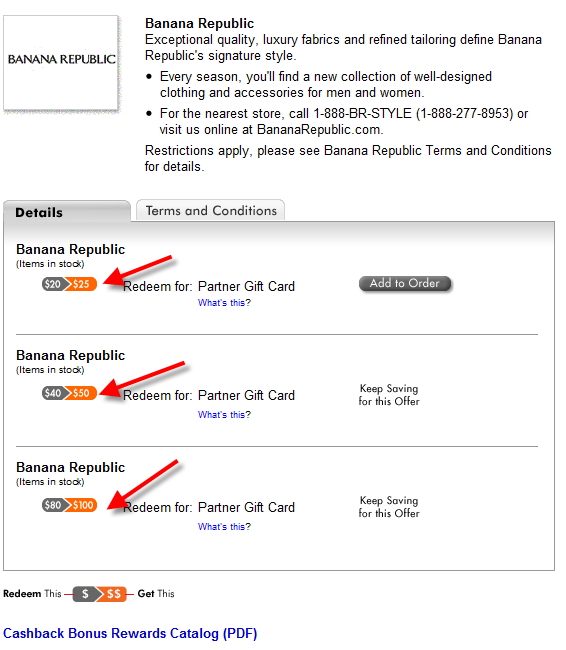

The advantage of having a card like the Discover® More(SM) Card is that not only do you earn rebates, you can choose to receive the rebates and spend them elsewhere if you wish to. In fact, if you decide to exchange your cash rebates for Banana Republic or GAP gift cards, you will get more than the value of the cash rebates you have earned. (see screen shot below).

So if you are actually looking at the Old Navy credit card, I would urge you to consider the Discover® More(SM) Card instead.

The retailer American Eagle Outfitter has a store credit card and a Visa credit card for folks who regular shop at their stores. Obviously, these cards gives you rewards for shopping at American Eagle stores. We’ll look at these two cards right now.

Features – The American Eagle credit card allows you to earn rebates at AE, aerie, ae.com, aerie.com and 77kids.com. You will earn 1% “extra savings” for all regular purchases. New cardholders get a 15% discount for their first credit card purchase. Cardholders will also get a 20% off birthday coupon (you need to give them your email address for this). Cardholders are also invited to “savings events” four times a year.

Once you are approved for the credit card or store card, you will be enrolled in the AE Rewards program. This is where your “extra savings” rewards come into play. Earn up to a certain number of points and you qualify for certain discounts at American Eagle stores.

Fees – There is no annual fee for this card.

Verdict – The American Eagle Outfitters credit card has a nice store and visa credit card that will appeal to those who really shop their often. There is though, a big problem IMO. And that is you do not earn any extra rebates from spending at their stores. They used to allow you to earn 4 points for every dollar that you spend at their stores. But now, all you earn in the regular one point per doillar. As for me personally, I’ve never thought it is a good idea to get a specialized store credit card because I just happen to things from many stores. If I were to get every store credit card that I shop at, I will need a bag to put all my credit cards! So I searched for the usual credit cards with shopping portal to see if you could also earn rebates from shopping at American Eagle Outfitters. And true enough, I found one – and it is the Discover® More(SM) Card.

For those of you who are not familiar, Discover has a shopping portal called shopdiscover.com. They have over 100 online merchant partners. When you go to AEO.com from your Discover account and shop online using your Discover Card, your purchases will be tracked and you will earn 5% rebates, which is more than the “4% rewards” that you earn with the AEO credit card. Furthermore, you do not have to use your rebates at AEO. You can redeem for cash or gift cards.

You will not find these info at Discover’s website (only cardholders can see it). So here is a screen shot what how this works.

Clicking on the American Eagle Outfitter icon takes you to a page with the fine prints and terms and conditions. Clicking on the “start shopping” button takes you to aeo.com.

Overall, I feel that you should get a card like the Discover® More(SM) Card instead rather than the American Eagle Credit Card since you can earn higher rebates and have more options to earn rebates at other retailers as well.

It is not my job to promote credit cards. Regular readers of this column know that I have been highly critical of the credit card industry in the past. That said, using a credit card is still highly advantageous. Just when I thought that I knew all of the reasons that credit card use is better than cash, today I learned a couple new ones.

Counterfeit Money

Until now, I really just thought that this was the domain of crime movies and Russian gangsters. Then, a friend of mine told me the story of how he received a counterfeit twenty dollar bill from an ATM. A bank employee identified the bill and confiscated it. He wisely asked for some documentation from the bank and is going to try to get some compensation from the bank that owned the ATM.

Needless to say, it is inherently impossible to have that problem when using credit cards. Nevertheless, it is interesting to note that it is actually the United States Secret Service that is authorized to investigate counterfeiting. They are actually a division of the Treasury, and their currency work pre-dates their function as a protective service for the President. Here is their website that explains how to detect counterfeit currency.

Downsides Of Debit

I have never been a big fan of debit cards. I tell people to never, ever use them when purchasing hotel accommodations, renting a car, or ing airline tickets. Hotels and rental cars will freeze a large sum of your cash beyond the length of your rental/hotel stay. Airlines, on the other hand, may or may not cancel your flight or go out of business entirely, leaving you with little or no recourse. In the event of a cancellation, you will likely be stuck in endless airline bureaucracy and delays trying to get your money back. If you used a credit card instead of a debit card, you could threaten a chargeback for services not delivered. That threat is very powerful as it will trigger higher merchant fees on all transactions for that company. The threat of a chargeback does just wonders in cutting through the red tape that has been intentionally constructed around all refunds.

In the event that the airline goes out of business, you will not be able to do a chargeback on your debit card, and will literally have to go to bankruptcy court to have any chance of receiving just pennies on the dollar for your money. If you think it can’t happen, think of Pan AM, Eastern Airlines, or any one of these airlines that went out of business when oil prices spiked in 2008.

Some people feel a lot more comfortable with debit cards. They know that they will never have to worry about incurring interest as the money is taken out of their account at the time of purchase. That is fine, but they do need to realize that the transaction is just about as permanent as handing someone cash. So long as you initially authorize the transaction, you have little outside recourse if the company fails to deliver the product or service. With debit cards, your protection is only in cases of theft or outright fraud, there are no chargebacks for non-delivery of products or services.

Last Thursday, it was my sad duty to report that credit card companies had not, at that time, chose to waive credit card interchange fees for donations for the Haiti disaster. In effect, they were skimming 2-3% off of the donations, a really despicable concept.

There was, in fact, a precedent set five years ago when they suspended processing fees for donations to non-governmental organizations (NGOs) in the wake of the Pacific Tsunami.

Credit Cards Finally Step Up To The Plate, Sorta…

Late Thursday, word came out that merchants had finally agreed to suspend credit card fees, in line with the precedent set after the Tsunami.

Visa Does The Right Thing, Temporarily

While that is good news, leave it to credit card companies and banks to hide the downsides in the small print:

“In a statement, Visa said it would not apply interchange fees, through February, to donations made to a select group of major charities — the names of which were still being compiled — that are providing support to Haitian relief efforts. The company said it would also donate any revenue that was generated by charitable donations related to the Haiti crisis through next month.”

So even though it will take years to rebuild Haiti, only donations during the first 6 weeks of the disaster will have interchange fees waived. After that, it is back to skimming from the pot….Great!

Mastercard Minimalism

Mastercard also agreed to waive it’s fees, but like Visa it left some serious loopholes:

“MasterCard Worldwide said it would waive interchange fees on relief donations made using United States-issued MasterCards to the American Red Cross, AmeriCares, Unicef, Save the Children and CARE U.S.A.”

Frankly, that is a pretty small list. For example, the Clinton Bush Haiti Fund is not even on there. Here is a list in the New York Times of 10 reputable funds that are delivering aid to Haiti. The five funds Mastercard is exempting are there, plus Convoy of Hope, Direct Relief International, Doctors Without Borders, Partners in Health, and Water Missions International. Mastercard is continuing to skim the pot from those and other charities. FOR SHAME!

Other Problems With Credit Card Donations

It typically takes a month or two for donated monies to reach recipients. I am not an expert in this matter, so I don’t know if charities are able to receive some portion of the funds or not, or how much aid is held up because of this. Either way, it seems as if this might be one situation where a check would be more effective than a credit card.

In The Future

The hopelessness of the situation in Haiti is truly depressing, yet perhaps some positive changes can come out of this situation. My wish is that all of the major credit card processors, Visa, Mastercard, American Express, and Discover, can come to some agreement to waive all interchange fees for charitable relief organizations in the future. It should not take a monumental disaster for these companies to do the right thing, albeit in a limited and/or temporary way.

My hope would be that they would both waive interchange fees and match with a donation of whatever cash back or points that the card would normally accrue. Based on their behavior so far, I am not holding my breath.

By now, you will all have been bombarded with news about Haiti. The scale of the disaster is just simply massive and the amount of suffering that is happening is just unthinkable. For many of us, getting there physically to help on the ground is not feasible. We can only say our prayers and make a donation to organizations that are on the ground helping out in the relief efforts. When the incident first appeared on the news, Mrs Credit Card and myself knew at the back of our head that we will chip in with some donations. Which left the task of deciding which organization should we donate to? But we also procrastinated (yes – lame excuses – I was actually learning to ski last week!). Then yesterday at church, there was an announcement that UMCOR (which is the United Methodist Committee on Relief) is affiliated with the church we go to and they have been in Haiti since 2005. They currently have 14 projects going on and one of them is obviously the urgent need for relief from the devastating earthquake. We also found out that 100% of the proceeds from donations go towards the relief effort. So Mrs Credit Card and myself have decided to make our donations to UMCOR.

And to spread the word around and encourage others to chip in as well, we’ve decided to do the following. We’ve decided to challenge our readers to give as well and we will make matching donations to UMCOR. So this is how we’ll do it.

1. For our readers who comment on this post – We will make a $1 donation for every comment on this post. Originally, we just wanted folks to tell us how they are helping and who they have donated to. But to prevent lots of “I donated $x to xyz organization” type post, we’ve decided to make it more interesting by requiring the following :

2. For our readers who are actually in Haiti helping out – If you are actually in Haiti and helping on the ground and you tell us about it on this post, we will make a $1 donation. But rather than just simply saying “I’m here”, please tell us

3. If you are donating using your credit card – We’ll make a $1.50 donation if you are actually donating to a charity organization through a credit card. You have to tell us in your comment as to which card you used, how you did it, with points or cash. (hey what else did you expect from me!)

Bloggers who blog about how they are helping in the relief efforts – I was thinking about approaching some of my blogging partners and friends to help spread the word about this. Then, while “surfing the net”, I realized that Crystal from Money Saving Mom had actually initiated something like this among her Mommy and Coupon Bloggers. So taking a leaf and further inspiration from her, I’ll make a $5 donation for any personal finance blogger (or any blogger for that matter) that blogs about how they are actually helping out (whether it be a donation or going to Haiti physically) or if you initiate something similar to what we are doing here. All you have to do to inform me is to submit the page where you wrote about it below in the little widget box.

I’ll leave comments open till this Friday.

Organizations to consider – There are many organizations to consider if you decide to make any donations to Haiti. Here are a couple of examples.

www.usaid.gov – which is an independent federal agency that has been the principal U.S. agency to extend assistance to countries recovering from disaster, trying to escape poverty, and engaging in democratic reforms.

Red Cross – Here is where you can make an online donation.

To celebrate British Airways inclusion as a partner in the Membership Rewards program, Membership Rewards is giving away 5,000 bonus British Airways Miles. All you have to do is to transfer a minimum of 1,000 Membership Rewards First points to BA miles and you will get 5,000 bonus miles. Just to clarify the fine prints, you will be charged a transfer fee of $0.0005 per point up to a maximum of $75. You have to transfer the points by 31st January 2010. You will get your 5,000 bonus BA miles by 28th February 2010. This promotion will suit any Platinum Card holder who just needs some extra points to get that free transatlantic BA flight.

Just for your knowledge, you need 50,000 BA miles for an economy ticket from US to UK, Belgium, France, Germany, Ireland, Luxembourg, Netherlands and Switzeland.

This is not a good week for the banks, as they are really trying hard to be the bad guys these days. Let’s take a look at what’s going on:

Skimming From Earthquake Donations

I have to admit that I am truly stunned by the devastation in Haiti. Unlike the Pacific Tsunami five years ago, the death and destruction is so geographically concentrated. It almost seems like a nuclear bomb went off there by both the pictures and the accounts of witnesses. While Americans and other people around the world make donations, the credit card companies have, so far, refused to waive their normal merchant fees. This article has more details.

For every hundred dollars donated, only about $97-$98 reaches the intended recipients. Apparently, the major credit card processors waived their merchant fees in the aftermath of the Pacific Tsunami, but now, they are more than happy to make a fast buck off of the current catastrophe. Clearly, such a waiver is warranted. The right and fair thing to do would be to code donations to non governmental relief organizations as “cash equivalent” transactions as well. In that way, donations would not incur merchant fees, but would not earn cash back or loyalty points either. The idea is simple: everyone should be encouraged to donate, and no one should be profiting from such untold misery. Of course, they could choose to donate cash back rewards directly to the charities, essentially providing a matching donation

Until the credit cards step up to the plate and waive merchant fees, SHAME ON THEM!

New Fees For Store Credit Cards

I am not really a big fan of store credit cards. These days, you can’t a pair of socks without the cashier giving you a pitch to save 10% on your purchase when you open up a new charge account. Unless you are doing a ton of business with a particular store, they are not such a great deal.

In fact, according to this article in The Consumerist, they are getting to be a worse deal. It seems that most store cards have decided to add a $1 a month “statement fee” for a paper statement. The idea is to encourage you to sign up for electronic statements. In theory, I like electronic statements, yet in practice I hate them. Every time I have ever signed up for electronic statements, I have regretted it. It is so easy to have an electronic statement flagged as spam. Even when you do receive it, you don’t really get a statement. Instead, you get an email that says that your statement is ready, but you must log in to their web site to view it. I really don’t have time to memorize the usernames and passwords of every company that I do business with, and then go through the 14 step process of logging in and downloading a statement. Call me a Luddite, but opening up the mail is just easier. Furthermore I fear that this is just the first of a tidal wave of new fees.

Banks Strongly Object To New Fees

This sounds like a great headline, until you realize that the only fees that a bank has ever objected to are fees on themselves. The Obama administration has proposed a “financial crisis responsibility fee” on the banks who’s bonus structure is encouraging the type of risky behavior that resulted in the financial meltdown.

Whether or not this fee will discourage behavior that endangers our economy, I don’t know, but I love the rich irony of imposing fees on banks and watching them trip over their tongues in trying to describe how fees imposed on them are bad.

In the end, any day that I can report on new fees on banks instead of new fees from banks isn’t all bad.

Ron Lieber at the New York Times is getting to be one of my favorite columnists on the subject of credit cards and personal finance. His most recent article sheds some light on the costs to merchants that credit cards impose. It is a must read.

Are Reward Card Users Selfish?

To me, the question is absurd. Are people who use coupons selfish? Am I selfish by taking tax deductions? Capitalism is inherently selfish, as we each try to maximize our earnings while minimizing our expenditures. Lieber brings up the old canard that reward card holders are subsidized by people who don’t use them. This idea even has a cool name, the “Reverse-Robin-Hood-Cross-Subsidy Hypothesis!” Coming soon to theater near you!

I am convinced that cannot possibly be the case, as there is no reason credit card companies would offer reward cards if they only exist because they are subsidized by other products. If I am a bank and I am offering two cards, with one subsidizing the other, why not just eliminate the unprofitable card?

What About Merchant Fees?

I have every sympathy for merchants who pay these fees. I am sure it is just the mirror image of the fees we consumers pay for using the credit cards, and the merchants are treated no better by the card processors than consumers are treated by their banks. I would even be in favor of some sort of regulation that makes card processors more competitive. That said, credit cards are optional for merchants in the same way that they are optional for consumers. My favorite bagel store in Denver does not take credit cards. Their bagels are good enough that I will pay cash or use a check. I guess that they decided that that the costs of handling cash and checks was less than accepting credit cards.

To Lieber’s credit, he does a good job of explaining the benefits to merchants of accepting credit cards:

People can use credit to spend more than they have in the bank at the moment, and some may spend more on a card than they would if they had to lay out a pile of money. Merchants who handle less cash, meanwhile, bear fewer costs for counting it, calling the armored car, and theft by employees or armed bandits.

It is refreshing to see that someone “gets it” when it comes to merchant fees. I have heard one too many business owners whine about merchant fees as if they are forced to pay them and accepting credit cards provides them with no value whatsoever.

Benefits To Consumers

Lieber also catalogs some, but not all of the non-reward benefits credit cards have to consumers:

…like ease of budgeting and record keeping, allowing you to avoid checks by paying monthly bills with a card, the ability to dispute charges and the time savings in not having to refill your wallet at an A.T.M. as often (and cost savings in not paying A.T.M. fees).

Oddly, he omits chargebacks, rental car insurance, and theft and loss protection. If I lose my wallet today, which holds no cash at the moment, my losses will be limited to the cost of a replacement wallet. That would not be the case if I carried enough cash around to make regular purchases, although you could argue a debit card is a good compromise.

Boycott?

Lieber suggests a consumer boycott of credit cards only to illustrate how it would never work. He then concludes, “There is no way for consumers to win.” Here is where I take objection. Clearly, as someone who, by his own admission, aggressively pursues credit card rewards, Lieber understands that it is very easy to win the reward card game. Simply find a card with the best rewards, and pay it off in full every month. If that’s not winning, I don’t know what is.

Surcharges? Oh No!

Lieber discusses all of the various proposals to allow retailers to offer discounts for cash or surcharges for credit card use. He rightly concludes that the difference between the two is merely semantics. Personally, I hate surcharges of all kinds. Post your best price, but don’t play games with surcharges. Once you start down that road, you end up like car rental companies or the telecommunications business where the surcharges can be as much or more than the “price”. Often cell phone companies can’t even give you the final price of their plan until the very end of the transaction. What a nightmare! Count me in as someone who prefers the status quo, where retailers can’t offer different prices depending on the method of payment.