Credit Repair Tricks: Using CD’s and Personal Loans to Raise Your Credit Score

We get a lot of questions here on Ask Mr Credit Card.com, and there have been some excellent ones on raising your credit score.

We get a lot of questions here on Ask Mr Credit Card.com, and there have been some excellent ones on raising your credit score.

Most people want to know both “How can I raise my credit score?” and “How can I raise my credit score as fast as possible?”

So I thought we would take a look at some simple tricks that really do help you raise your credit score faster. The first one involves getting a CD at your bank, and then using that CD as collateral for a personal loan. This is completely legal, and it does raise your credit score.

Here are the basics, in case you want to try it for yourself:

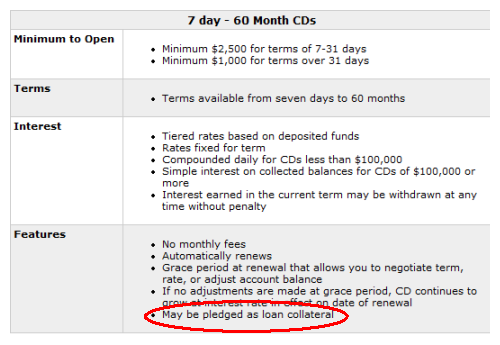

Call or visit your local bank online to check their rates on CD’s. You may also want to consider various online banks because they sometimes offer higher rates on CD’s than brick and mortar banks do.

*Warning: If you normally do your banking with a credit union, then you will need to ask a manager whether or not the credit union will report the loan to all three credit bureaus. If they do not, then this strategy will not work for you – find a bank that will report your new loan to the credit bureaus instead.

Once you’ve settled on a bank and an interest rate for your CD, read the fine print. Most banks will specify whether or not the CD may be used as collateral for a bank loan. My bank, BB&T has that information on it’s main CD page:

Here’s the quick and simple checklist:

1) Find a bank that you are comfortable with

2) Make sure the bank will report a loan to the credit bureaus

3) Take out a CD

4) Wait about a month – Give the bank time to process the CD, and to get everything in order.

5) Walk into the bank and set up a loan using the CD as collateral.

You can click here to get a printable walk through that covers the entire process step by step.(Microsoft Word File)

Setting up your loan:

Applying for a secured loan (using a CD as collateral) will always get you a better interest rate on the loan than applying for an unsecured personal loan. This is especially important if you have a low credit score. Before you go into the bank to apply for a loan, there are a few things you will need to get together and take with you.

- Copies of your pay stubs – make sure that you have at least the last month’s check stubs from your regular job. You may need to take in proof of up to six months of regular paychecks. If your check is directly deposited then print out your last few statements that show a record of the regular deposits.

- Work up your monthly budget – You will be expected to prove that you will have the money to repay the loan each month. You will also need to be prepared to list your assets, and liabilities on the loan application.

- Put your papers in order – Make sure you have your driver’s license, social security number, and any paperwork relating to your CD with you when you apply for the loan.

- Call your bank beforehand – Do a quick check to make sure that your bank will not require you to bring anything else. You want to be as prepared as possible so that you don’t waste a trip, or have your FICO score pulled more than once because you weren’t prepared and had to apply for the loan twice.

What now?

Once you have secured a personal loan by using a CD as collateral, what then? The best thing you can do in this situation is to put the money from the loan into a savings account with the same bank. Do not spend it! Remember that you are just using the loan to raise your credit score, not to finance anything.

Your next step is to set up two auto-drafts to take care of making the payments on the loan. Schedule an automatic withdrawal from your savings account to your checking account, and a separate auto-withdrawal to make the loan payment out of your checking account. Make sure you have at least four days in between drafts so that your bank has time to process everything correctly.

This is very important! I know it’s annoying, and technical, but it puts the entire process on autopilot. You repay the loan, and you never have to think about it again. If you choose not to do this step, then at least mark a calendar each month when the loan payments are due.

What about the interest?

Because you are choosing to take out a secured loan, the interest rate will be lower than with an unsecured loan. You will still have to pay interest on the loan though. The interest that you pay on the personal loan is the cost of raising your credit score quickly.

It is actually cheaper to pay the interest on this loan than to pay the fees and interest on unsecured “bad credit” credit cards, and your credit score does benefit. I can tell you from personal experience that raising your credit score is not cheap. The lower your score is, the more it will cost you to raise it.

*Tip: You can offset some of the interest on the loan by putting the money the bank loans you into a high-interest savings account. That way, you will be earning interest on the money that you borrowed from the bank while you are paying the loan back.

Once the loan has been repaid, be sure to check your credit score. At this point, you can repeat the process and continue raising your score.

One final note:

Once your loan has been repaid you should draw up a letter stating that you made your payments on time, as agreed. Take it into your bank, and have your bank manager sign it. You can then take this letter with you when you apply for an auto loan, a home loan, or even another personal loan. Attach your bank statements to the letter, and highlight the sections that show regular payment on the loan. Keep it in a safe place, and next time you need a loan it will be ready to go!

You can click here for a sample letter that verifies you paid your personal loan on time and in full. (It’s at the bottom – Microsoft Word File)

Have a question for us? Leave a comment below!

Keep Reading: